Effective Revenue Cycle Management Throughout Your Patient Journey

The healthcare sector is on a journey of profound change, as small practices consolidate into larger multi-location practices, expanding their presence. Consolidation and expansion, however, often shine a spotlight on sector inefficiencies. Most significantly, in relation to revenue cycle management (RCM).

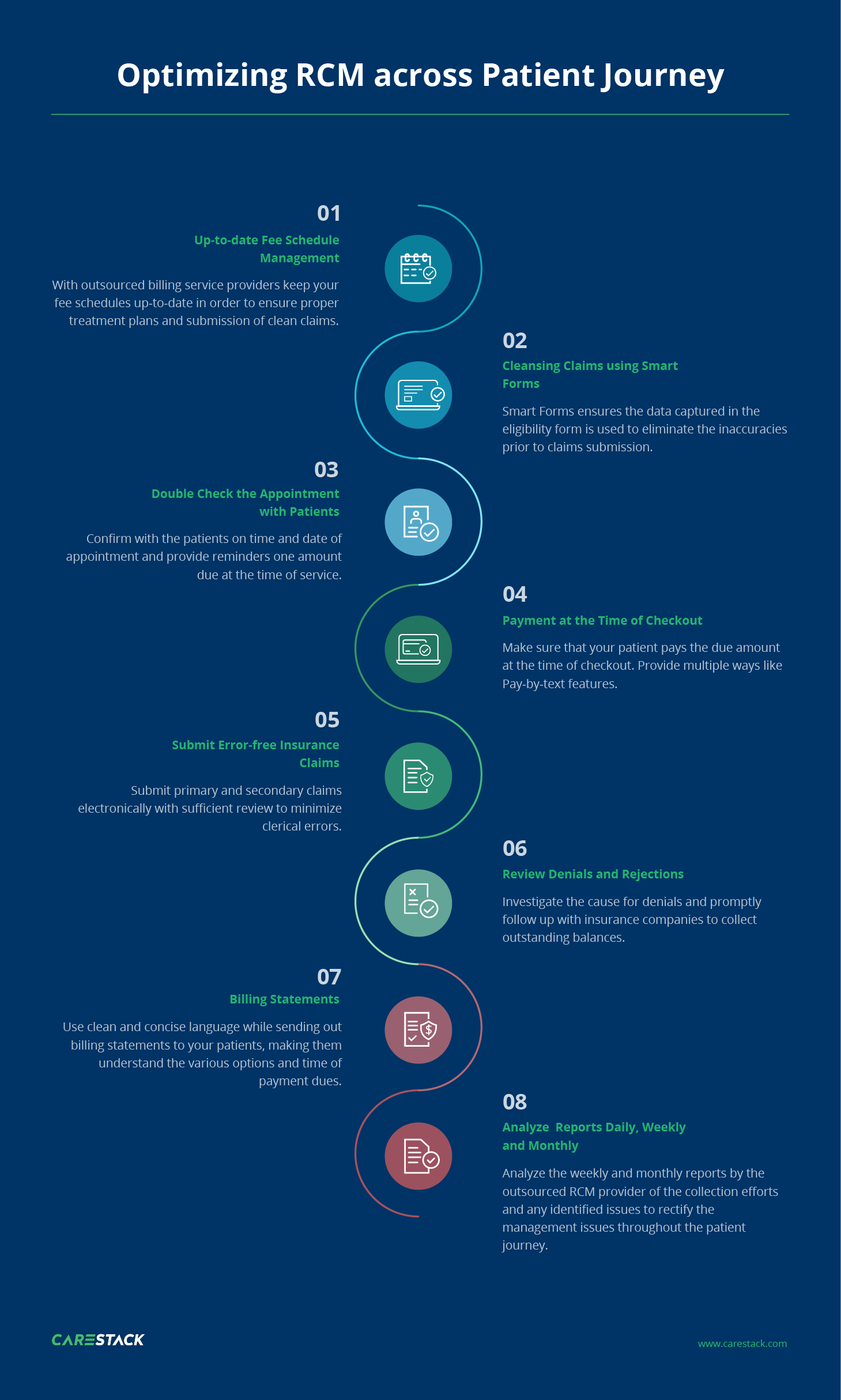

Improving the revenue cycle is more about streamlining existing workflows than digitizing them. During the medical billing process, RCM solutions help ensure that you follow the correct steps at all stages of patient engagement. This involves prior-to-visit activities such as verification of insurance coverage, during-the-visit workflows such as collecting co-pays, and after-visit duties of claim application and rejection management.

The global revenue cycle management market size is projected to reach USD 216,990.6 million by 2026, exhibiting a CAGR of 12.4% during the forecast period. Rising labor costs in the healthcare sector will be the chief growth driver for this market, enumerates Fortune Business Insights™ in its report, titled “Revenue Cycle Management Market Share and Industry Analysis By Structure (In-house Outsource) By Function (Claims & Denial Management, Medical Coding & Billing, Clinical Documentation Improvement (CDI), Insurance, Others) By Type (Software, Services) and Regional Forecast, 2019 – 2026”.

Source: Fortune Business Insights

The growth trend in RCM

Revenue cycle management (RCM) is projected to experience an annual compound growth rate of 11.8 percent from 2018 to 2024. Healthcare officials are in dire need of streamlining RCM to handle rising patient payment rates (expected to rise to $515 billion in 2019), loss of revenue due to bad debt, new government legislation, and boosting EHR adoption

A proven RCM system is crucial in optimizing existing medical billing processes at your dental practice. In many EHR systems or medical practice management systems, RCM processes can be used to better handle patient involvement in medical billing services.

Why RCM becomes important in the patient journey

60% of patients consider changing their dental provider due to poor treatment experience. To cater to the new priorities, the dental care system itself is transitioning to a value-based care model from the existing fee-for-service system. With this, delivering quality care and improving patient experience becomes paramount in retaining and adding to the existing patient numbers.

RCM becomes crucial in the new landscape as it can simultaneously leverage revenue opportunities at each stage of the patient journey and, at the same time, provide ample scope for improving the patient experience at each point if operated well. This creates a win-win situation for the patient and provider where the patients are ensured a faster, smoother, and more effective treatment experience, and the provider can cut down the cost-to-collect and minimize bad-debt risks.

From the first phone call to the final settlement, RCM has to be optimized, building upon patient inclinations and empowering them with proper information and services such as pre-service estimates, due reminders, multiple payment methods, etc. This ensures that payment delay does not happen because of misinformation or other factors. With RCM holding this much potential, using the right RCM software becomes critical in the financial health of your dental practice.

Benefits of RCM software

Improving the management of the revenue cycle is essential to a dental practice’s financial well-being. The longer it takes to access patient payments, the stability of the earnings of the practice becomes unnecessarily tagged to these payment collections. Though this approach looks convenient (as you earn payment each month), you are not in the best position. If income takes a month longer to hit you, there is a massive cost of opportunity, one that often goes unnoticed.

Irrespective of whether a practice accepts insurance, and keeps accounts receivable (A/R) low, the use of modern revenue cycle management systems can fix critical gaps in implementing an effective revenue cycle management strategy.

1. Eligibility checks to reduce late & rejected payments

It is better to stem a problem at the source. If your patient scheduling mechanism had been intuitively prioritizing patients who are more likely to pay on time, you would not be facing a revenue cycle issue, to begin with. The key here is to ensure that you can do this eligibility check fast and before the patient checks in. A modern dental practice management system manages this process with simple one-click solutions.

2. Error-free claims submission with just a single click

The collected information can be compiled into an error-free claim that is ready to be sent for processing. Automated workflows ensure due process and leave little margin for error. This saves valuable time and effort while processing claims, leading to a predictable revenue cycle.

3. Make informed choices in treatment planning

Being able to choose the right plan for a patient, based on his insurance and payment capability, helps reduce confusion while billing. Furthermore, the choices made available for the patient will improve the patient experience and ensure that the patient made the best available choice.

4. Automated ERA postings for faster and better accounting

ERA postings have always been a source of constant headaches for dental practices. The latest practice management systems enable you to completely automate this, making your accounting and collections more streamlined. Problems and discrepancies are detected early, and corrective measures can be taken pre-emptively.

5. Payment reminders to ensure faster collection

As a practice owner, you would have seen your collections increase when you actively follow up on receivables. Many times all it takes is a timely reminder to get a payment. These are the low-hanging fruits in the collection. Such follow-ups should be consistent and timely to be able to work. Automation features in modern practice management solutions ensure your collection effort runs consistently and efficiently.

6. Automation and process streamlining

Most of the financial processes currently utilized have a lot of redundancies that do not need active human participation. These systems, once converted into automated workflows, make processing not just faster but also cheaper and more accurate. Therefore, when considering automation of practice management, choose a player that understands the workflows and is ready to customize and align with industry best practices.

Billing, coding, and collections are sophisticated yet crucial for maximizing cash flow and profitability. Therefore, employing the apt practice management solution helps enhance the effectiveness of capturing revenue at each stage of the patient journey. Choose a system that allows and is keen to expand on its automation abilities and is built for improving revenue cycle management.

CareStack Revenue Cycle Management Services

With CareStack’s end-to-end revenue cycle management services, your practice can maximize reimbursements and cash flow in a go. With a proven process in RCM optimization and In-house experts specialized in billing and collections we have been ensuring greater than 90% first-pass acceptance rate and 40% reduction of days in A/R.

Book a demo with CareStack to experience how outsourcing your dental billing service helps you focus on caring for patients and providing excellent care — not sweating over claims management and patient collection.